Riva Prosivo:

Discover Investment Learning Opportunities via Riva Prosivo

Sign up now

Sign up now

Finding reliable investment education can feel intimidating. Resources appear from multiple sources, yet coherent direction is difficult to identify. Structured learning brings clarity to this complexity, offering organized ways to comprehend core principles. Riva Prosivo eases this journey by linking learners with independent education organizations that focus on investment topics, without influencing their content. Its purpose is strictly connection, not teaching.

Many individuals spend considerable time browsing guides, viewing tutorials, or joining online forums. Content is abundant, but understanding grows gradually. Organized education helps these efforts align, allowing ideas to integrate and recurring trends to become visible over time. Riva Prosivo supports this process by enabling initial contact while keeping the experience impartial and low pressure.

Have you ever explored tutorials only to feel confused or uncertain about the takeaways? That occurs when material lacks structure or coherence. Riva Prosivo fills that gap, offering a clear entry point and making the educational experience more cohesive and meaningful.

Learning typically begins with basic concepts. Foundations are established first, followed by more complex principles added gradually. Historical examples are introduced over time, revealing recurring patterns and trends. Education progresses steadily, prioritizing thoughtful analysis over hasty conclusions. Instead of accepting information blindly, learners ask questions. Rather than relying on guesswork, comparisons and evaluations are made. Each subject receives careful attention, with no guarantee of specific outcomes.

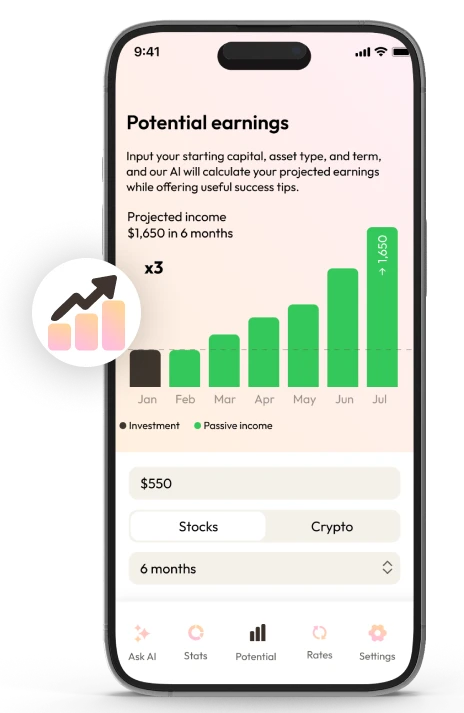

Investment learning influences thought long before it directs choices. As understanding deepens, ideas become clearer and more deliberate. Reactions slow, and decision making gains intention. Research skills improve. While historical events remain relevant, tools like data charts, trend cycles, and comparative analysis grow increasingly valuable. Education weaves these elements together, providing a broader and more coherent perspective on the investment landscape.

Riva Prosivo creates impact by removing barriers at the very beginning. Individuals seeking investment knowledge often struggle to identify where to start. The site eases this by connecting learners with independent education providers. It does not control content or influence decisions. Its strength is in providing clear pathways. Contact is made smoothly, without urgency. Learning unfolds at a measured, deliberate pace, allowing curiosity to guide the journey.

Riva Prosivo distinguishes itself by staying completely impartial. No advice is given, and no materials are promoted. Registration is simple users share only a name, email, and phone number. After that, the connection occurs, and the site’s role pauses. This separation ensures that learning remains self directed, giving room for individual reflection and growth. Knowledge develops through thoughtful discussion and consideration. Remember, while education provides context and perspective, markets such as cryptocurrency are inherently volatile, and losses can occur.

Signing up is simple and fast. Its only function is to capture interest in investment learning and share it with independent education providers. No courses, examples, or explanations appear at this stage. Learning itself does not start here. The step exists solely to open a line of contact.

After submitting your details, the information is routed to relevant education firms. Each provider may respond differently, covering various topics, teaching styles, and timelines. Riva Prosivo does not rank, endorse, or favor any provider. Interaction is fully personal no automated lessons or advice, just direct communication.

Completing registration does not guide decisions or guarantee outcomes. It does not remove risk or provide results. From this point, the learning journey continues as individuals explore, question, and compare educational material. Independent research is essential, and learners remain responsible for how they use the information received.

Riva Prosivo acts as a bridge connecting learners with independent education providers. The site itself does not deliver lessons or instructional content. Its purpose is purely to facilitate communication, giving users access to educational programs that focus on how markets operate rather than promising specific results. Topics typically cover market mechanics, historical trends, and investor behavior. Learning develops organically through interaction no advice or actions are prescribed.

Education accessed via these connections often starts with broad principles. Instructors explain concepts like price formation, trend dynamics, and the influence of market sentiment. Historical examples, including past slowdowns or volatility events, illustrate recurring patterns. These lessons are designed to enhance understanding rather than predict future movements. The emphasis is on comprehension, not speed.

Investment learning frequently emphasizes recurring behavioral tendencies. Topics may explore how emotions such as fear, optimism, or caution influence decision making and market movements. Charts and historical case studies demonstrate how these emotional patterns can reappear over time. The goal is to develop awareness and observation skills, not to forecast outcomes. In volatile markets like cryptocurrency, potential losses remain a real consideration.

Education also highlights the boundaries of market behavior. Markets are not always predictable, and unforeseen events can disrupt expectations. Instructors stress that risk cannot be eliminated entirely. Understanding these limits helps learners avoid overconfidence, integrating risk awareness as a core part of their educational experience.

Many learning opportunities encourage ongoing evaluation and reflection. Learners compare perspectives, revisit past examples, and refine understanding over time. Independent research remains essential, and consulting qualified financial professionals can help validate insights before acting on them. This approach builds durable knowledge and a measured perspective on market behavior.

Riva Prosivo is designed to create meaningful links between learners and independent education providers.

Education starts when individuals can reach reliable, impartial resources. The emphasis is on cultivating comprehension, rather than promoting particular perspectives.

This initial connection lays the groundwork for thoughtful engagement, providing context, clarity, and a framework for informed exploration.

Structured organization is a core part of learning about investments. Clear presentation of concepts helps participants process complex ideas efficiently. Rather than reacting impulsively to market fluctuations, well organized education groups related topics, making it easier to compare, evaluate, and understand patterns.

Riva Prosivo supports this by providing a simple, guided path to independent educational providers. With easy registration and direct connections, learners can engage thoughtfully, reduce mental clutter, and progress steadily.

Maintaining neutrality is key to effective investment learning. Riva Prosivo does not endorse content or promote opinions. Once a connection is made, interactions remain free from pressure, allowing learners to form independent insights. This unbiased environment encourages critical thinking and enables users to make decisions based on understanding rather than influence.

Clear boundaries make the learning experience more reliable. Unlike sites that mix advice with promotion, this approach separates factual information from opinion based content. Learners gain balanced insights, fostering critical evaluation and prompting consultation with qualified professionals when necessary.

Learning becomes more effective when clear boundaries are set. Unlike sites that combine recommendations with promotional content, this method keeps instructional material separate from opinion or marketing influence. Learners gain impartial and well rounded insights. Such structure encourages analytical thinking and motivates individuals to seek advice from qualified professionals when necessary.

Investment education does not remove uncertainty or promise outcomes. Its purpose is to develop awareness gradually. As learners interact with educational resources, understanding grows through consistent study and thoughtful reflection. Questions become more precise over time. Reviewing multiple viewpoints ensures balanced comprehension. Consulting with certified financial professionals offers an opportunity to validate insights and refine judgment before taking action. Remember, markets including cryptocurrency remain volatile, and losses are always possible.

Setting clear boundaries reduces uncertainty. Riva Prosivo exists to enable access, not to teach or advise.

It links users with independent education providers who focus on investment knowledge. Materials shared through these connections emphasize understanding, context, and concepts.

No particular steps are recommended, and no results are guaranteed. The emphasis stays on learning itself, not on achieving predefined outcomes.

Riva Prosivo does not remove market risk or guarantee certainty. It does not predict outcomes, deliver lessons, offer trading signals, or give personalized guidance. No advice or opinions are shared, and no recommendations are made. Its purpose is limited to establishing a connection. How information is interpreted and applied is fully the responsibility of the user.

Market movements often occur subtly before becoming apparent. Educational exchanges help explain why measured observation matters and why reacting too quickly can lead to errors. Some pauses happen before price shifts, yet many are inconsequential. Learning emphasizes understanding patterns rather than forcing immediate decisions.

The site facilitates access to these insights by linking individuals interested in investment education with independent educators. Registration simply initiates communication, keeping the process neutral, direct, and straightforward.

Investment learning works best when clear limits are established. The focus is on understanding market dynamics, not prescribing specific actions. Boundaries separate explanation from instruction. Prices fluctuate, trends evolve, and participation shifts. Education highlights these movements without telling learners what to do, allowing information to be interpreted as insight rather than directive.

Another crucial boundary relates to interpretation. Lessons illustrate behavioral patterns and decision making tendencies without promising particular results. Historical market events reveal recurring reactions under different conditions. These examples provide context and perspective, not predictions. Boundaries ensure learning remains realistic and grounded.

Riva Prosivo is built to perform one clear function: connecting individuals with independent investment education providers. It does not deliver instruction or teaching.

No courses, lessons, or explanations are hosted on the site. This transparency ensures users immediately understand the site’s purpose, avoiding misunderstandings or misplaced expectations.

The sign up process is intentionally minimal. Users provide only a full name, email, and phone number. These details let educational firms reach out directly without unnecessary complexity. By keeping registration simple, the focus remains on productive, meaningful learning conversations instead of navigating forms or systems.

Neutrality is maintained at every step. The site presents no opinions or recommendations. Once contact is established, educational firms share their own methods and content. This clear separation fosters independent judgment and ensures learners can explore material without external pressure.

When communication begins, the learner assumes full responsibility for their education. Research continues independently, questions evolve, and comparing perspectives adds depth. Engaging with qualified financial professionals supports informed decision making. Users should remember that markets remain unpredictable, and cryptocurrency in particular carries high volatility and potential losses.

Clear limits strengthen confidence. The site never directs decisions or guarantees outcomes. After opening communication channels, it steps back, allowing learners to proceed independently. This separation keeps the process transparent, focused, and sustainable over the long term.

Investment education thrives when each participant’s responsibilities are clearly established. Educators focus on sharing fundamental concepts, historical market behavior, and recurring patterns without telling learners what actions to take.

Learners actively engage by analyzing content, asking insightful questions, and choosing which topics to investigate further. A well defined framework reduces misunderstandings, encourages thoughtful exploration, and replaces rushed decisions with deliberate learning. When roles are clearly separated, expectations are grounded, and boundaries are respected, the learning experience becomes more meaningful and effective.

Investment education focuses on helping individuals grasp how markets operate instead of offering ready made solutions. It covers essential topics such as market mechanics, participant behavior, and historical trends. The goal is to foster thoughtful understanding rather than guarantee outcomes. While it provides useful perspective, ultimate decisions depend on personal judgment and ongoing research.

Riva Prosivo connects users with independent education providers specializing in investment topics. The site itself does not supply lessons or teaching materials; it simply enables introductions, allowing learning to take place through the providers. This keeps the educational process under the learner’s control.

No investment education explains patterns and behaviors rather than instructing on trades. By highlighting trends and contextualizing information, it encourages comprehension and awareness without suggesting specific moves or guaranteed results. Learning focuses on insight, not direct advice.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

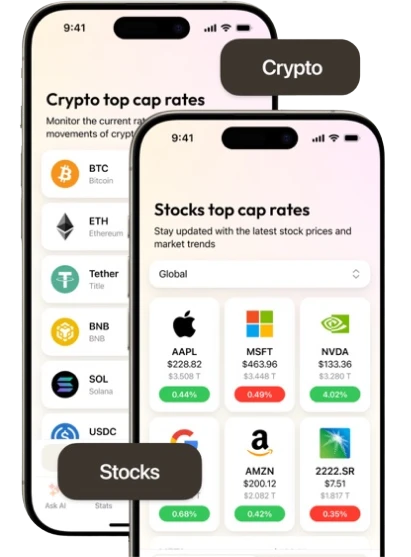

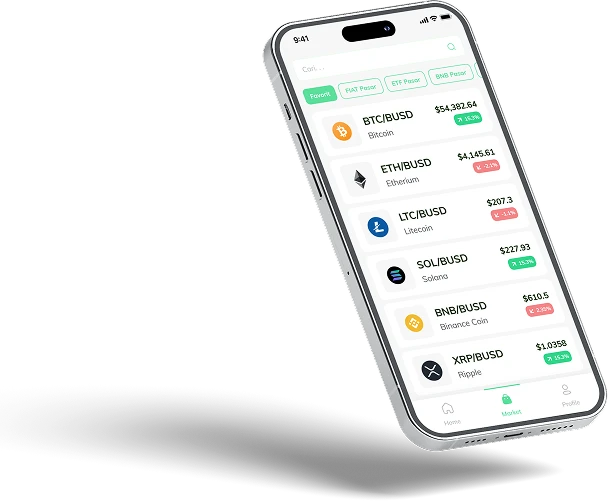

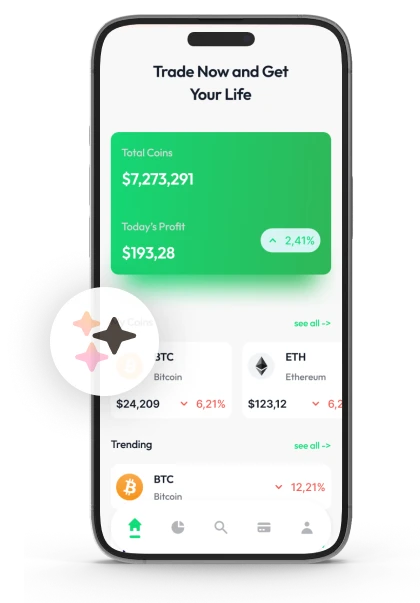

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |